The IPO Plan

Bengaluru-based Groww has filed its updated draft red herring prospectus with the Securities and Exchange Board of India, setting the stage for one of the most awaited public issues in the fintech space. The proposed offering will consist of a fresh issue of Rs 1,060 crore and an offer-for-sale component estimated at Rs 5,000-6,000 crore. This combination of fresh capital and secondary share sales will allow Groww to both raise funds for expansion and provide an exit route to some of its early investors.

Shareholders Selling Stakes

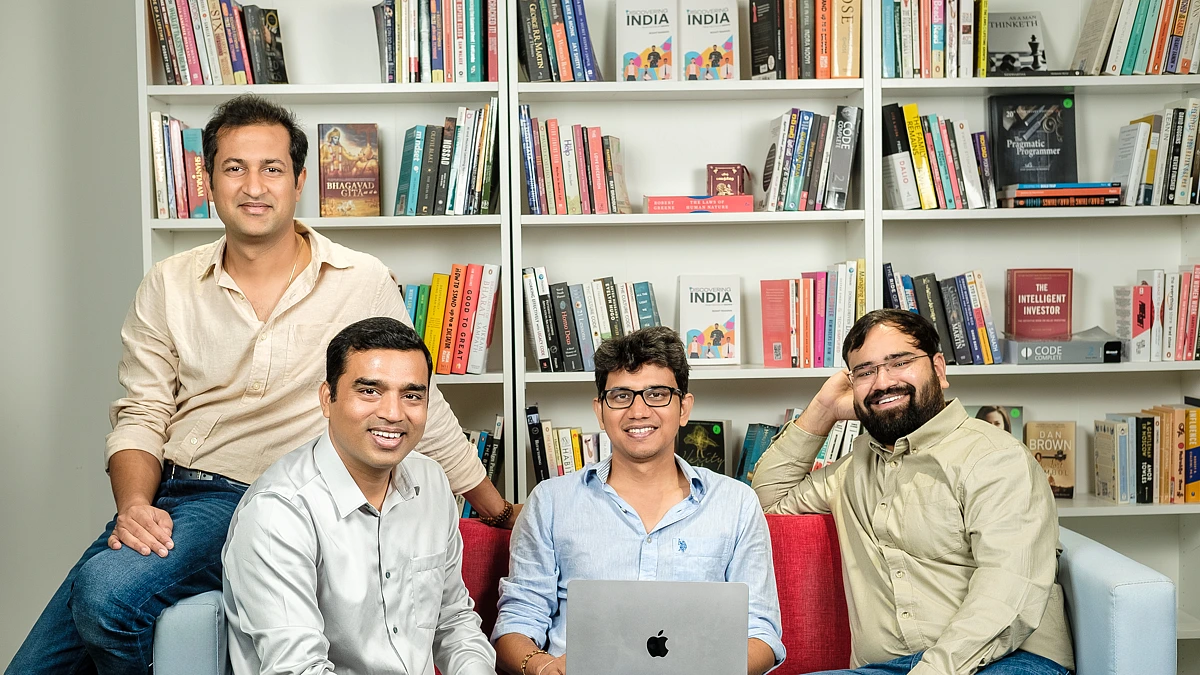

Several marquee investors are set to participate in the offer-for-sale. Peak XV Partners, Y Combinator, Ribbit Capital, Tiger Global, and Kauffman Fellows Fund will offload part of their holdings. The four founders, Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, who collectively hold close to 28 percent in the company, will also each sell one million shares. Despite the sales, the founders are expected to retain significant stakes, continuing to steer Groww’s long-term vision.

Valuation and Timeline

According to earlier reports, Groww is targeting a November listing with a potential valuation in the range of $7-9 billion. The company had first filed confidential papers with SEBI in May and received regulatory approval last month, clearing the way for the revised prospectus. If successful, the listing will mark one of the biggest IPOs in India’s fintech sector, following in the footsteps of marquee offerings from digital-first companies over the past two years.

What Makes Groww Stand Out

Founded as a simple online platform to democratize investing, Groww has grown rapidly to become one of India’s most widely used apps for mutual funds, stocks, and other investment products. Its appeal lies in offering a user-friendly interface for first-time investors while also scaling up to serve more seasoned market participants. Backed by some of the most prominent global venture firms, the company has become a key player in the country’s fast-expanding digital finance ecosystem.

The Bigger Picture

Groww’s IPO reflects the rising investor appetite for India’s fintech sector, which has been reshaping how millions of Indians save and invest. With increasing smartphone penetration and growing trust in digital financial services, the timing of the issue comes amid favorable market sentiment. A successful listing will not only boost Groww’s profile but also highlight the maturity of India’s startup ecosystem.

The Bottom Line

Groww is gearing up for one of the largest fintech IPOs in India, aiming to raise up to Rs 7,000 crore and secure a multibillion-dollar valuation. With big-name investors, a strong customer base, and the backing of SEBI approval, the company is positioning itself to make a significant impact in public markets.

Follow YouFinance on Instagram and Facebook for more simplified updates on IPOs, startups, and the latest from India’s financial markets.