Where Crypto Stands in India

Cryptocurrency in India occupies a grey zone. It is not illegal, but it is not legal tender either. You cannot buy groceries with Bitcoin at a local store, but you can trade it and hold it as an asset. The government classifies it as a Virtual Digital Asset, which allows ownership but comes with heavy taxation. Despite the uncertainty, India has emerged as the global leader in crypto adoption for two years in a row, showing just how deeply digital assets have captured public interest.

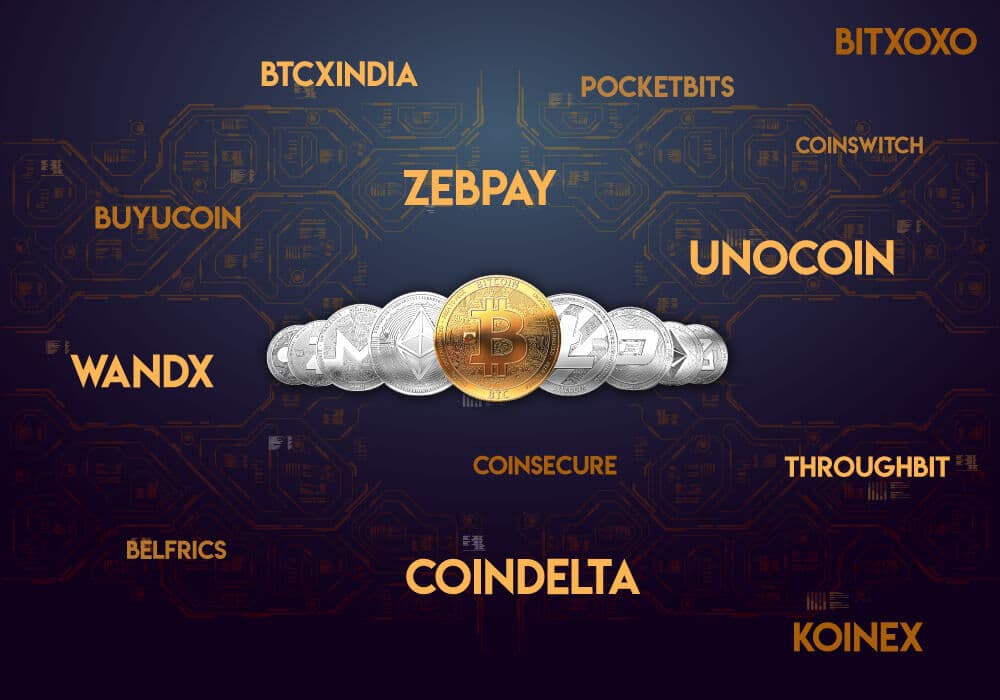

How to Buy Your First Crypto

Buying crypto in India is similar to buying stocks. Instead of a Demat account, you need a crypto exchange account. After completing KYC, you can deposit money via UPI or bank transfer. Another option is buying stablecoins like USDT directly from sellers through peer-to-peer trades, which act as a bridge between INR and other cryptocurrencies.

Once your account is funded, you can choose pairs like BTC/USDT or ETH/USDT and make your first trade. It is wise to start small and use limit orders to avoid poor pricing. But remember, if your coins remain on an exchange, you do not truly own them. Transferring them to a cold wallet gives you full control and greater security. The golden rule remains simple: not your keys, not your coins.

Trading vs Investing in Crypto

Trading crypto is about timing the market and taking advantage of short-term price swings. It requires technical analysis, an understanding of liquidity, and a willingness to handle high volatility. The spot market is the simplest way to trade, though advanced traders also use futures and options to magnify gains or hedge risks.

Investing, on the other hand, is about long-term belief in the fundamentals of a few strong cryptocurrencies. Many investors adopt strategies like dollar-cost averaging, where a fixed amount is invested regularly regardless of price, just like a mutual fund SIP. This smooths out volatility and builds a position over time.

Whichever approach you choose, risk management is crucial. Traders need stop-losses and portfolio rebalancing, while investors need diversification to avoid putting all their money in one coin.

Understanding Crypto Taxes in India

Taxes are the harshest part of the crypto story in India. All profits from trading or investing in crypto are taxed at a flat 30 percent rate with no deductions or exemptions. On top of this, every transaction above ₹50,000 attracts a 1 percent tax deducted at source. This means that without careful planning, your gains can shrink quickly. Consulting a tax advisor is recommended for anyone serious about trading or investing in digital assets.

The Regulatory Landscape

The Reserve Bank of India has historically been cautious, even imposing a banking ban in 2018 before the Supreme Court struck it down in 2020. The Ministry of Finance has tightened tax rules, while SEBI has pushed for regulation of crypto-linked products. A draft bill proposing restrictions on private cryptocurrencies has been floated but remains unpassed. This leaves crypto in India as a controlled but not banned asset class.

Final Thoughts

Crypto can be exciting, but it is not a guaranteed road to riches. For every Bitcoin millionaire, there are countless stories of scams, failed projects, and reckless speculation. If you approach it with knowledge, discipline, and a clear plan, crypto can be a valuable part of your portfolio. If not, it can just as easily turn into a gamble.

Follow YouFinance on Instagram and Facebook for the latest insights on crypto, markets, and investing made simple.